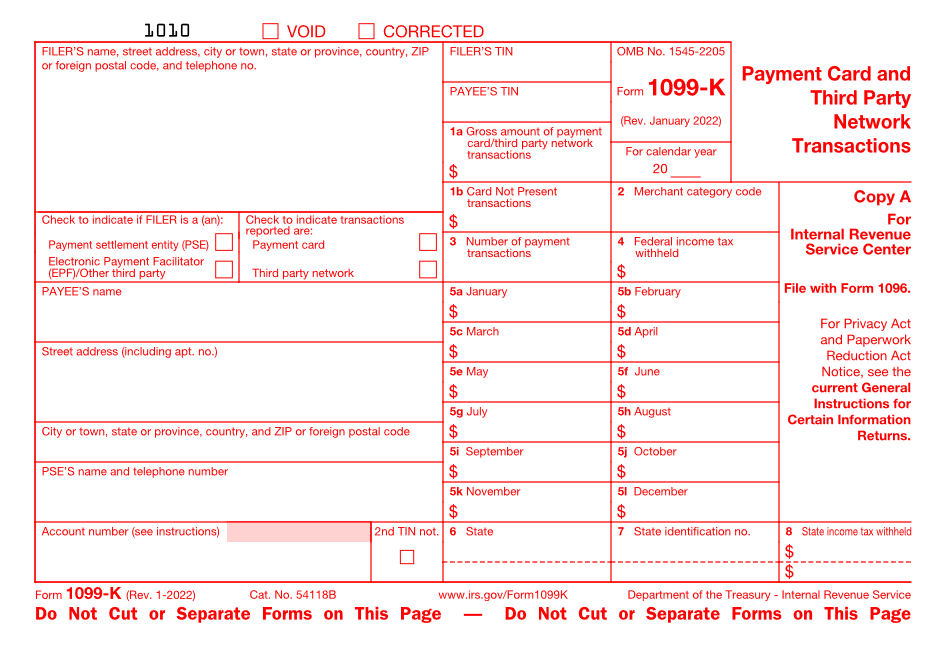

In a letter to Congressional leadership of the Senate Finance Committee and the House Ways and Means Committee, the American Institute of CPAs expressed deep concerns regarding the Form 1099-K, Payment Card and Third Party Network Transactions, reporting threshold that was lowered to $600 for 2022 and will lead to significant confusion in the tax system in the coming months.

Under section 9674(a) of the American Rescue Plan Act of 2021 (ARPA), the de minimis threshold decreased from $20,000/200 transactions to $600 for any number of transactions, effective for 2022 Forms 1099-K, due to be filed in 2023.

According to the AICPA, the $600 threshold is based on a threshold established by the Internal Revenue Code section 6041 established in 1954 and does not account for increases in the cost of living that have happened over the last 70 years.

The de minimis threshold for information reporting was lowered as part of ARPA, enacted in March of 2021, and will substantially increase the number of Forms 1099-K required to be filed with the Internal Revenue Service (IRS) and furnished to recipients by third-party settlement organizations and their electronic payment facilitators.

“The excessive reduction in the de minimis reporting threshold for third-party network transactions has created a significantly large reporting burden,” the letter states. “When the potential for matching is overlayed with IRS’s continuing processing backlog, more needs to be done to ensure that taxpayers and practitioners are not faced in 2023 with yet another tax filing season with unprecedented backlog levels leading to additional delays in processing returns and correspondence, historically low levels of telephone service, and incorrect notices and penalties being assessed and sent to taxpayers.”

The AICPA recommends that the section 6050W(e) de minimis exception for reporting be cost-of-living adjusted4 (COLA) using 1954 as the base period for the $600 COLA and supports the National Taxpayers Union Foundation recommendation that the threshold be raised to “a level sufficient to exempt casual or low-level online activity,” agreeing that $5,000 would constitute significant progress.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes